Salary after tax

The calculator is designed to be used online with mobile desktop and tablet devices. US Tax Calculator and alter the settings to match your tax return in 2022.

Work Out Your Salary After Taxes At Maltasalary Com Salary Workout Tax

50k after tax Salary and tax calculation based on 202223 ATO tax rates and tax calculations - Full income tax and medicare deductions.

. Tax example for 50000 using the Austrlia Tax Calculator iCalculator AU Excellent Free Online Calculators for Personal and Business use. After taking 12 tax from that 16775 we are left with 2013 of tax. For instance an increase of 100 in your salary will be taxed 3955 hence your net pay will only increase by 6045.

This places US on the 4th place out of 72 countries in the International Labour Organisation statistics for 2012. Minimum Salary For Filipino Maid In Dubai In 2021. Your gross salary - Its the salary you have before tax.

In order to calculate the salary after tax we need to know a few things. United Arab Emirates salary after tax calculator. Your average tax rate is 165 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate.

The Monthly Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. The United States economy is the largest and one of the most open economies in the world representing approximately 22 of the gross world product. Moreover as per the Income Tax Act 1961 it is mandatory for every taxpayer to provide Form 16 before the due date.

If you make 55000 a year living in the region of Texas USA you will be taxed 9076That means that your net pay will be 45925 per year or 3827 per month. Quick Accurate results. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Stuttgart and Munich follow closely behind at 53592 33933 after tax and 53886 34085 after tax respectively. Form 16 provides the details of gross salary deductions exemptions and TDS for the purpose of computing tax payable and tax refundable. You can see that the highest median salary was found in Frankfurt coming in at 54080.

If you make 52000 a year living in the region of Alberta Canada you will be taxed 15602That means that your net pay will be 36398 per year or 3033 per month. Is The Salary In Dubai Tax-free. That corresponds to a take-home pay of 34185.

Your average tax rate is 345 and your marginal tax rate is 407This marginal tax rate means that your immediate additional income will be taxed at this rate. This 90k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Iowa State Tax tables for 2022The 90k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Iowa is used for calculating. UAE Salary Calculator gives an estimation of the salary you will get in hand after all tax deductions.

Your average tax rate is 212 and your marginal tax rate is 396. If you are a member of the Swedish Church - The church fee varies between 1-15 of your salary. Your average tax rate is 300 and your marginal tax rate is 357This marginal tax rate means that your immediate additional income will be taxed at this rate.

This marginal tax rate means that your immediate additional income will be taxed at this rate. If you make 300000 kr a year living in the region of Aabenraa Denmark you will be taxed 103464 krThat means that your net pay will be 196536 kr per year or 16378 kr per month. Your average tax rate is 259 and your marginal tax rate is 338.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Given that the second tax bracket is 12 once we have taken the previously taxes 10275 away from 27050 we are left with a total taxable amount of 16775. Tax System in the UAE.

While income tax is the largest of the costs many others listed above are taken into account in the calculation. Where you live - The municipal tax differs between the municipalities. For instance an increase of 100 in your salary will be taxed 3380 hence your net pay will only increase by 6620.

The 150k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Vermont is used for calculating state taxes due. This 150k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Vermont State Tax tables for 2022. Review the full instructions for using the Ireland Salary After Tax Calculators which details.

Income Tax Due Date Income Tax Income Tax Return Income Tax Due Date

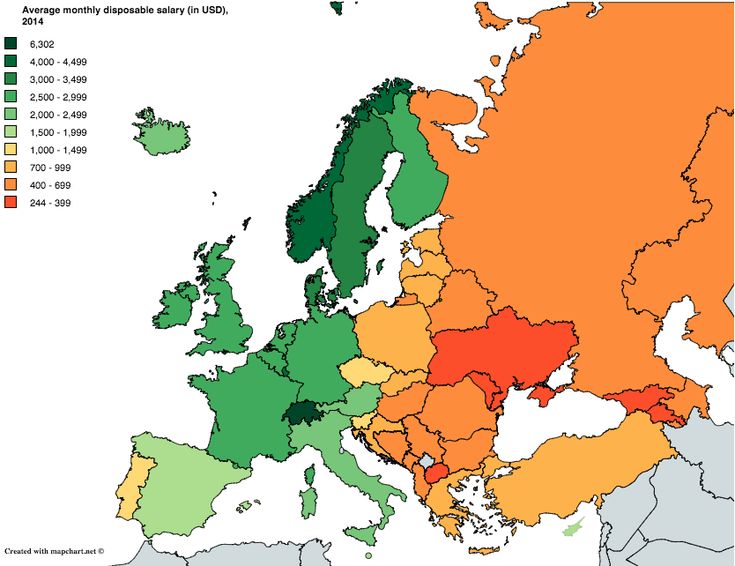

Amazing Maps On Twitter Amazing Maps Europe Map Map

Yearly After Tax Income For 100k Yearly Salary In The United States The Federal Income Tax On A 100k Yearly Salar Salary Federal Income Tax Additional Income

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live Salary Life Money Hacks Smart Money

Which U S States Have The Lowest Income Taxes Income Tax Income Pinterest For Business

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

After Tax Income On 50000 In Canada For 2014

Income Tax Just Joined Your First Job Here S How Income Tax Is Calculated On Your Salary Business News Income Tax Tax Saving Investment Income

Salary Calculator Salary Calculator Calculator Design Salary

Salary Ctc Components And What Is Taxable Financial Planning Investing Income Tax

Decode Your Salary Slip Components And Their Importance Tax Deducted At Source Salary Income Tax

Income Tax Paid By Republic Of China

What Is Annual Income How To Calculate Your Salary

Ctc Salary Structure Income Tax Salary Employment

Pre Tax Income Vs Income After Tax Your Real Pay Budgeting Money Money Management Advice Pinterest For Business

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary