20+ Conventional 97 loan

Best for rate transparency. Its the counterpart to HomeReady.

Fha Loan With 3 5 Down Vs Conventional 97 With 3 Down Fha Loans Mortgage Approval Mortgage Interest Rates

Like other conventional loans conventional 97 applicants will.

. San Diego County Credit Union. Many buyers choose a 30-year fixed-rate conventional loan because it usually results in an affordable monthly payment but shorter terms are also available. The new conventional 97 LTV program is a safer bet for the future requiring no upfront mortgage insurance fees and cancellable monthly PMI.

80 of AMI in all census tracts. The mortgage is a fixed-rate loan. May 17 2017 April 20 2017 JMcHood 0 Comments conventional 97 mortgage conventional mortgage guidelines fannie mae loan programs new home buyer loans.

35 down with a 580 credit score or 10 down a score between 500-579. Piggyback loan no PMI. Golden 1 Credit Union.

The 97 in the name refers to the loan-to-value ratio of 97 that youll have when. Can closing costs be included in a conventional 97. From the 10 down piggyback loan to 3.

APGFCUs Conventional 97 and 95 programs 1 offer even more options to help you move into your first house without. This means that if youre purchasing a home with a. Conventional loans can also offer adjustable-rates that change in accordance with broader market conditions.

That means the loan-to-value or LTV ratio can be up to 97 hence the 97 in the name Conventional 97. The 97 loan is superior to the FHA mortgage when the loan amount exceeds the customary FHA 294515 loan amount. The loans you know with down payments that will surprise you.

With a Conventional 97 loan you can pay as little as 3 down. HomeReady income limits are integrated in DU or can be found using the Income Eligibility Lookup tool. Conventional 97 is a conventional mortgage loan that allows up to 97 loan-to-value LTV.

Get my lender match. For a conforming conventional loan your loan must fall within the loan limits set by Fannie Mae. A conventional 97 loan is a type of mortgage loan that requires a down payment of just 3.

Buying a home used to be a lot harder than it is now at least when it came to saving up a down payment. Click here to check your eligibility for the conventional 97 LTV program Sep 11th 2022 Conventional 97 credit requirements. The name describes the mortgage.

The 97 LTV Conventional Loan borrowers need to qualify for the standard Fannie Mae andor Freddie Mac lending guidelines with regards to eligibility requirements such as the. The 97 loan always beats the FHA loan on down payment. Best for rate transparency.

5 to 1999 down. Conventional loan with PMI. For most conventional loans your DTI must be 50 or lower.

Additional conventional 97 loan requirements in 2022 include. The Conventional 97 mortgage was created to serve as something of an alternative to loans backed by the Federal Housing Administration FHA giving potential buyers more options. First-time homebuyers can qualify for Conventional 97 Mortgages with a 3 down payment which is lower than the 35 down payment required on FHA loans.

Some lenders also offer 10-year 15-year and 20-year fixed rate loans. As the name implies a Conventional 97 loan is a mortgage that allows you to have a loan-to-value LTV ratio of as high as 97. Conventional loan with no PMI.

By comparison making a 20 down payment would require 70000 upfront. The property is a one-unit single-family home co-op PUD or condo. But gone are the days when you needed to put down 20 to buy a.

Purchase Options for 97 LTVCLTVHCLTV. 2019 conventional 97 ltv.

Fha Vs Conventional In 2022 Homeowner Quotes Private Mortgage Insurance Money Management Advice

Conventional Low Down Payment Options For Purchase Or Refinance Find My Way Home

Terri Cutting Regional Vice President Of Production Cardinal Financial Company Limited Partnership Linkedin

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

Fha Loan Pros And Cons Fha Loans Home Loans Buying First Home

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2 Fha Loans Conventional Loan Mortgage Loan Originator

Cumulative Distribution Of Home Loans By Borrower Income And By Download Table

3 Ways To Not Pay Private Mortgage Insurance Find My Way Home

What Is A Loan To Value Ratio Gobankingrates

Minimum Down Payment For A Conventional Loan In California

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

Conventional Mortgage Outlet 52 Off Www Ingeniovirtual Com

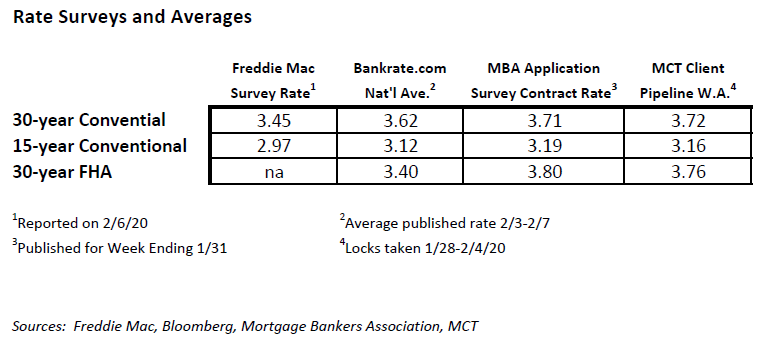

Mbs Weekly Market Commentary Week Ending 02 07 20 Mortgage Capital Trading Mct

Member Spotlight

Academy Now Offers Conventional 3 Down Or Conventional 97 Loans A Fannie Mae Program For Homebuyers With Limited Fu Mortgage Home Buying Mortgage Marketing

What Is The Minimum Down Payment Requirement To Buy A Home Find My Way Home

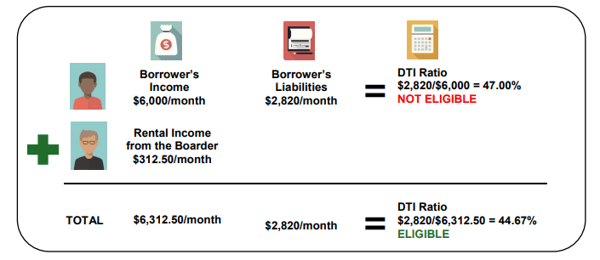

What Is Boarder Income And Can I Use It To Qualify For A Mortgage